when is tax season 2022 canada

The tax-filing deadline for most Canadians for the 2021 tax year is on April 30 2022. Since April 30 2022 falls on a Saturday your income tax and benefit return will be considered filed on time in either of the.

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

The tax-filing deadline for most individuals is April 30 2022.

. Tax Changes in 2022. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. Note down tax filing dates and how to file taxes in 2022.

February 21 2022 Montreal Quebec Canada Revenue Agency. Canadians continue to be eligible to receive a tax credit for home office expenses incurred while working from home. The government has also announced changes to the tax brackets for 2022.

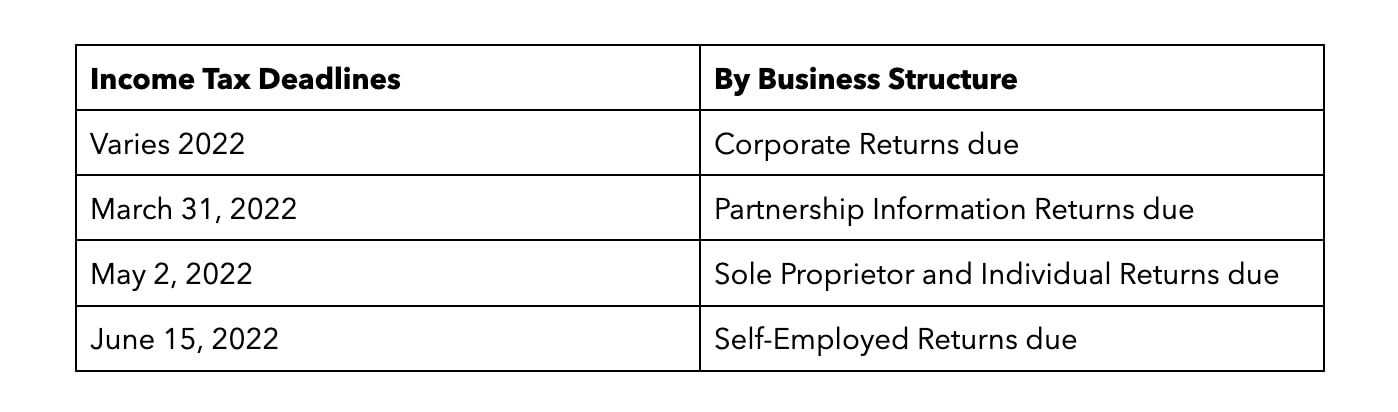

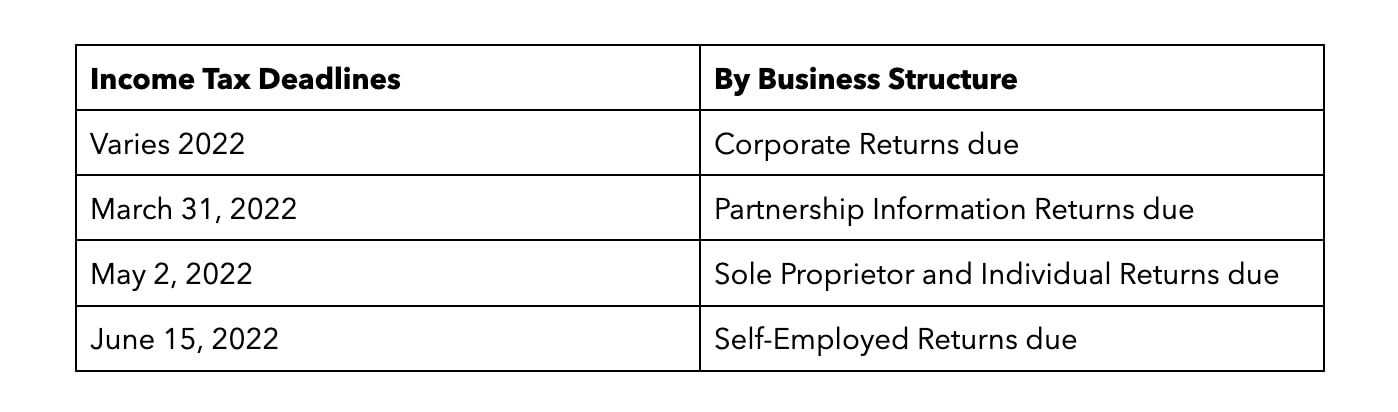

Important Dates to Help you Get Ready. These changes are as follows. You have until June 15 2022 to file your return if you or.

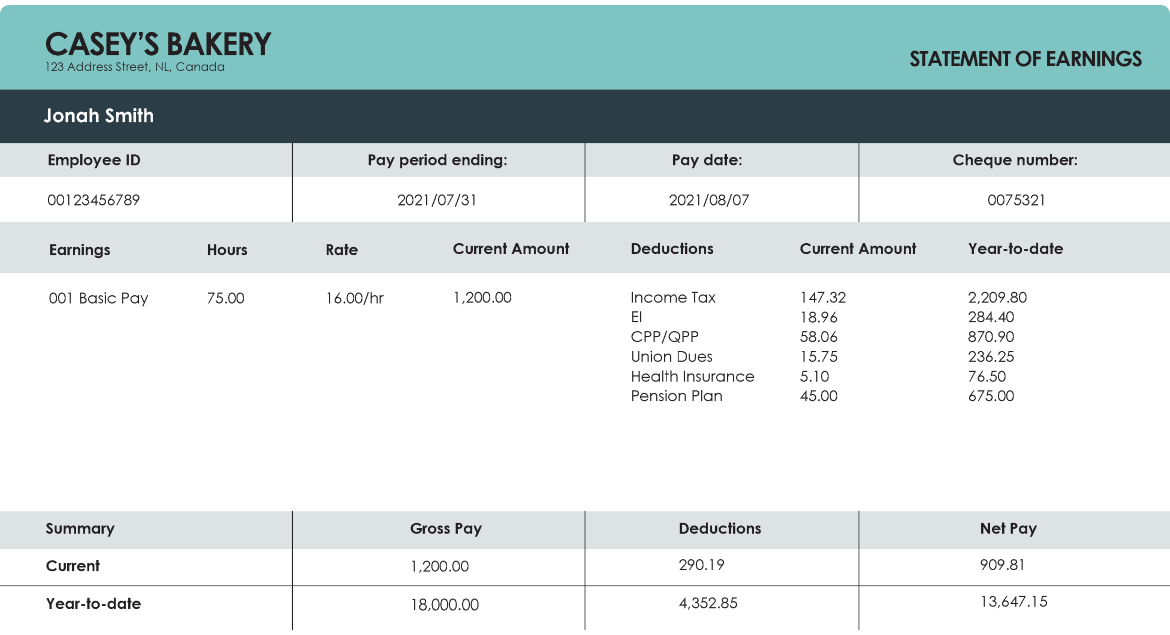

Last day to issue T4s T4As and T5s to employers and CRA Canada Revenue Agency. This falls on a Saturday so as long as the CRA receives the return on or before May 2 it is considered on. The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by.

The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. Tax tips if youre working from home Mar 30 2022. The Deadline for the Fiscal Year 2021 Personal Tax Returns will be May 2 2022.

The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. Tax filing season is the busiest and stressful time of the year for our experts. Heres what Canadians should know about the oddities surrounding the 2022 tax season.

The 2022 tax filing season in Canada kicked off on February 21 2022. 2022 Canada Tax Season Deadlines Penalties After a long year with lots of changes to the way we run our businesses due to COVID the 2022 tax season is on the. The tax-filing deadline for most individuals is April 30 2022.

Because April 30 our usual tax deadline. Bruce Ball vice-president of taxation at CPA Canada told Global News in an email that there are many benefits to the flat. Federal Tax Rate Brackets in 2022.

Filing deadline for most individuals is April 30 2022. E-filing open for resident and immigrants in Canada for 2021 tax year. For the 2022 tax season in Canada the deadline is April 30 2022.

Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following situations. The tax deadline in Canada every year is April 30. Using the simplified method you can claim up to 500 this.

The first tax bracket will be increased from 12298 to 13000. The Canada Revenue Agency CRA is committed to making sure residents of Quebec get the benefits and. What you need to know for the 2022 tax-filing season.

The tax filing deadline for your 2021 tax return is May 2 2022. This deadline is a bit tricky because taxes owing are still due May. For instance Emmas 2021 and 2022 taxable.

NETFILE opens on February 21 2022. But for 2022 this date is a Saturday so were getting a little extension May 2 2022 is our official tax deadline this year. Temporary expansion to the eligibility for the Local.

Mail-in a paper copy. If you or your spouse earned business income in 2022 then your tax return is due June 15 2022. If you filed a paper return last tax season in Canada the CRA should automatically mail you the 2021 income tax.

This new tax season will have a new deadline date on May 2 2022. Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following. 2022 Income Tax in Canada is.

Tax deadline is extended kind of Last year the CRA surprised everyone when they.

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Income Tax 2020 Changes Every Canadian Needs To Know Income Tax Income Tax Return Money Mom

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Tax Deductions For Small Businesses Video In 2022 Tax Deductions Deduction Income Tax Return

2021 2022 Income Tax Calculator Canada Wowa Ca

Become A Canadian Millionaire With 16 50 Per Day The Tfsa Explained Youtube In 2022 How To Become Millionaire Finance Tips

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2022 Personal Finance Lessons Personal Finance Personal Finance Blogs

More Tax Refund 9 Ways To Maximize Your Tax Return In Canada How Taxes Work In Canada Youtube In 2022 Tax Refund Tax Return Tax

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Non Resident Tax Services In Canada In 2022 Tax Services Income Tax Return Tax

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

When Are Small Business Taxes Due Quickbooks Canada