amazon flex driver tax forms

Be 21 or older. Have a valid US.

How To File Amazon Flex 1099 Taxes The Easy Way

DSPs provide their team with full benefits such as paid time off and health insurance for full-time.

. Tap Forgot password and follow the instructions to receive assistance. 1099 Forms Youll Receive As An Amazon Flex Driver. Knowing your tax write-offs can be a good way to keep that income in.

Amazon Package Delivery Driver - Earn 1500 - 3450hr. Adjust your work not your life. Choose the blocks that fit your schedule then get back to living your life.

To be eligible you must. Schedule C is part of a Form 1040 individual tax. Gig Economy Masters Course.

Simply 1 Reserve a. The main tax form you need to file is Schedule C. Use your own vehicle and smartphone to deliver packages locally for.

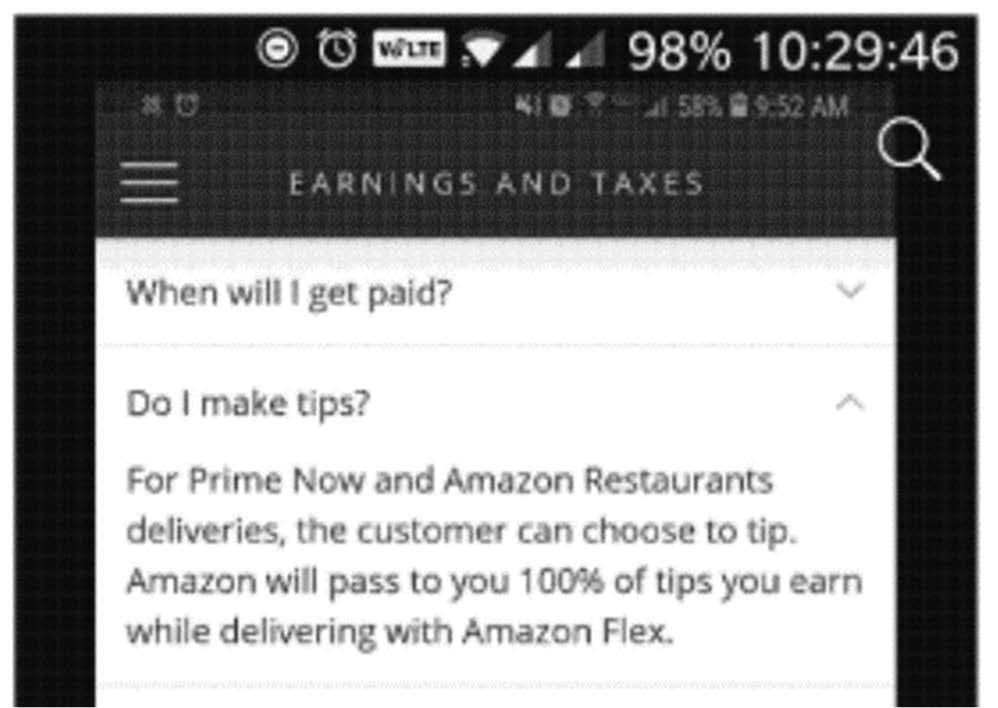

1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC. No matter what your goal is Amazon Flex helps you get there. Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers.

A 1099 form is a series of documents the IRS calls an information return defined as a tax return that contains taxpayers identifying. Amazon Flex is a self-employed delivery driver opportunity where you can use your own car SUV minivan or cargo van to deliver packages to Amazon customers using the Amazon Flex app. Select Sign in with Amazon.

Have a mid-size or larger vehicle. What is Amazon Flex. Or download the Amazon Flex app.

12 tax write-offs for Amazon Flex drivers. Increase Your Earnings. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906.

The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or. With Amazon Flex you work only when you want to. Actual earnings will depend on your location any tips you receive how long it.

Delivery drivers have competitive compensation of at least 20 per hour at select stations. We would like to show you a description here but the site wont allow us. Most drivers earn 18-25 an hour.

This is where you enter your delivery income and business deductions. Driving for Amazon flex can be a good way to earn supplemental income.

How To Become An Amazon Flex Driver Hyrecar

Tax Deductions For Uber Lyft And Amazon Flex Drivers How To File The Perfect Tax Return Youtube

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

Driving With An Llc Or Corp How To Send Your Ein To Uber Or Lyft Ridesharing Driver

Become An Amazon Flex Driver To Earn Cash Small Business Trends

Simon Kwok Ridesharedash Twitter

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Amazon Flex Background Check What You Must Know Ridester Com

Understanding 1099 Forms For Delivery Drivers In The Gig Economy

Guide To Filing Tax Returns For Delivery Drivers In 2022

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Can You Really Make Money With Amazon Flex Amazon Flex Driver Review

Drive For Uber Deliver For Amazon Here Are Tax Rules To Know

Help For Flex Drivers How To Get Results From Amazon Flex Driver Support Gridwise

Adding Up Wages Instead Of Waiting On 1099 R Amazonflexdrivers

Amazon To Pay 61 7 Million To Settle Ftc Charges It Withheld Some Customer Tips From Amazon Flex Drivers Federal Trade Commission

Help For Flex Drivers How To Get Results From Amazon Flex Driver Support Gridwise

![]()

How Much Tips Do You Earn With Amazon Flex Prime Now Deliveries Money Pixels